Pawn Loan Vs. Bank Loan

If you're considering taking out a loan, you may be wondering what the difference is between a pawn loan and a bank loan. Here's what you need to know: pawn loans are typically shorter in term and have higher interest rates, while bank loans are longer in term and have lower interest rates. However, both types of loans can help you get the money you need when you need it. So which one is right for you? Read on to find out!

Pawn Loan Advantages

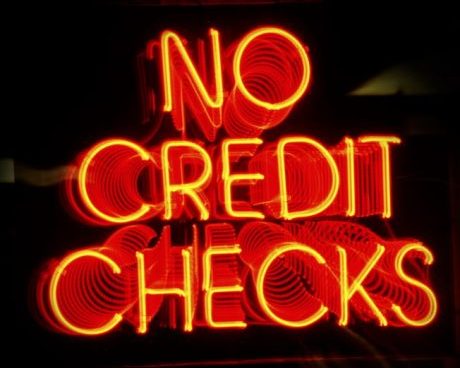

Have you ever been in a pinch and needed some quick cash? A pawn loan could be the perfect solution for you! If traditional loans are too hard to access, pawn loans offer the convenience of no credit checks and same-day cash. Who would have thought that pawning your valuable possessions could get you out of a sticky situation quickly and easily? Forget all the stress that comes with applying for a personal loan – pawn loans offer a much faster way to receive money when you need it most.

Understanding Pawn Loan

If you find yourself in a financial bind, pawn loans are the collateral loan for you. With these short-term loans, you can secure your loan with something valuable like jewelry, instruments, or electronics - no credit check required! They aren't the most low-interest way to go – but hey, at least you don't have to answer endless questions about your history of borrowing and paying back. Instead, if you want fast cash and don't mind allowing a temporary “hold” on one of your prized possessions until you pay off the loan in full (plus interest!), then this is probably your best bet.

Bad Credit?

Is your credit score low? Don't worry, no need to call your family for money, you can get a no-credit loan instead! We all know that banks sometimes make no exceptions when it comes to credit scoring, but getting a no-credit verification loan is still an option for those looking for emergency funds. Pawn Shops provide no-credit check loans for a quick and easy access to money without having your credit history scrutinized. So whether it's a rainy day or not, no-credit loans provide a no-stress solution to anyone in need of some cash – no matter their credit history.

Traditional bank Loan Process

Applying for a bank loan is like providing the bank with an invitation to conduct an extensive background check: bank statement reviews, credit history assessments and pages of paperwork. It’s often tedious and time-consuming, especially when you consider that bank loans usually require good credit in order to get approved. If you're after a cash need fast then bank financing might not be for you—you may just want to take out a pawn loan instead! While bank loans offer stability, funds from pawn loans can be released instantly, with far fewer bank loan requirements.

In conclusion, if you're prepared to wait around and commit to jumping through some hoops, going through the bank loan process may be worth it in the end.

Bank Loan Default

As with any bank loan, there's a ton of fine print that most people don't think twice about. Every time you take out a bank loan, you should make sure you're aware of the potential consequences of defaulting on it. After all, if you don't pay the bank, they can foreclose on your home-- and that is certainly no laughing matter! If you want to play it safe and avoid bank loan cons like this one, it's worth it to research the details carefully before signing on the dotted line.

Conclusion

A Pawn Loan is the perfect way to get fast cash when you need it most. Whether you're in-between paychecks or your credit score has taken a hit, you can easily find quick and secure funding through a pawn loan, continue reading about additional Pawn Loan advantages. Banks tend to have stricter requirements for loans, meaning you might be out of luck, but pawn brokers may be more lenient and willing to work with your situation. Not to mention, unlike bank loans, if you default on your loan from a pawn shop, at least you get to keep whatever item(s) you put up for collateral. So, what's the easiest way to get a no-credit loan? Pawn loans! And where? At your local pawn shop! Avoid the hassle of paperwork and strict requirements from banks and get the money that you need with utmost convenience. If you are in New York, NY and you need cash today, contact New York City Luxury Pawn Loans